Home > Travel Loan

Wherever You’re Going, We’ll Help You Get There

- Fast Funding for Flights, Hotels & Travel Costs

- Flexible Monthly Payments You Can Afford

- No Collateral, No Surprises — Just Smooth Travel

Turn Dream Destinations Into Real Plans

Get the Experience — Without the Wait

Whether you’re booking a well-earned vacation, a destination wedding, or an international adventure, we makes it easy to borrow with confidence and pay over time.

Cover Every Part of Your Journey

Use your loan to fund everything from flights and accommodations to excursions, car rentals, and more. It’s your trip — you choose how to use it.

Predictable Payments, No Surprises

Enjoy fixed monthly payments and fully transparent terms. No hidden fees. No last-minute charges. Just clear, responsible financing.

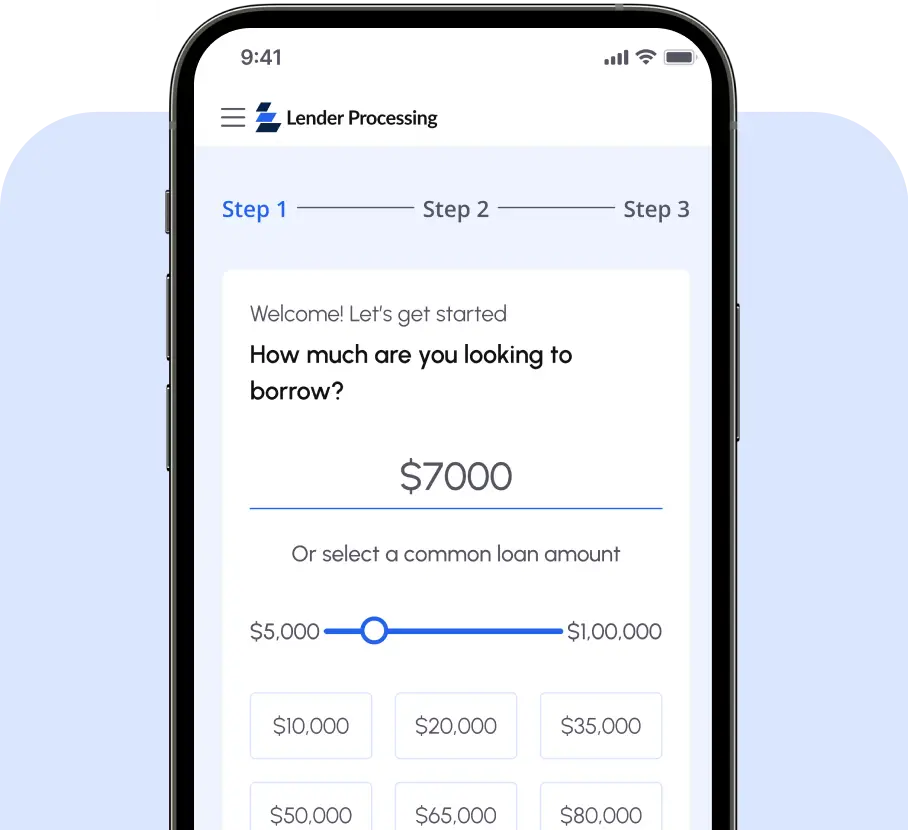

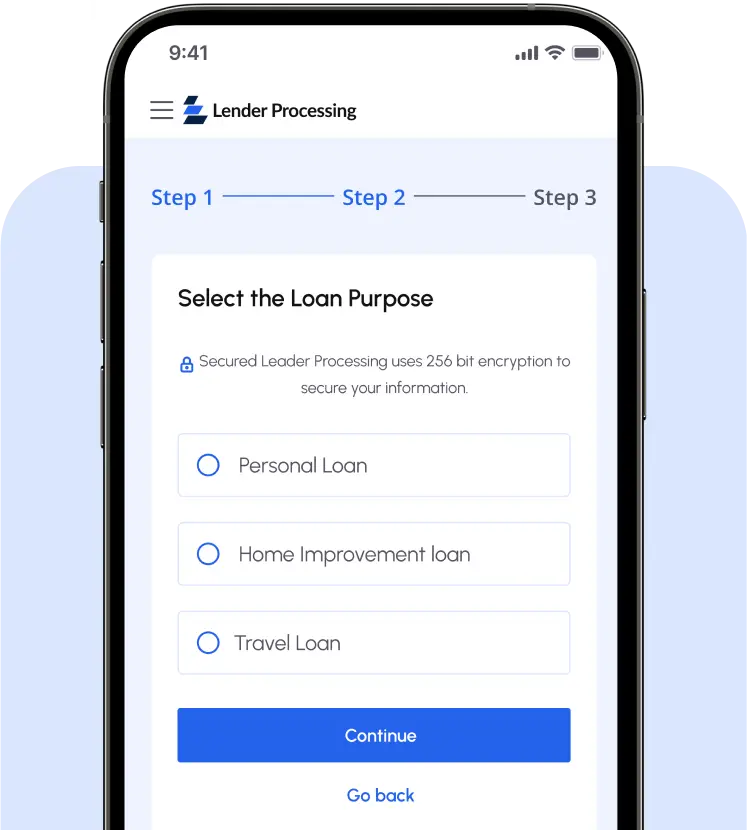

Fast, Simple Travel Loans in 3 Steps

Apply Online

Tell us about your plans and financial needs. Our secure application takes just a few minutes to complete.

View Your Loan Options

Based on your location and credit profile, you’ll see eligible offers from Lender Processing or one of our licensed lending partners. No pressure — just clear information to help you decide.

Book Your Trip

Once approved, most loans are funded within 1 business day — so you can start planning (and packing) right away.

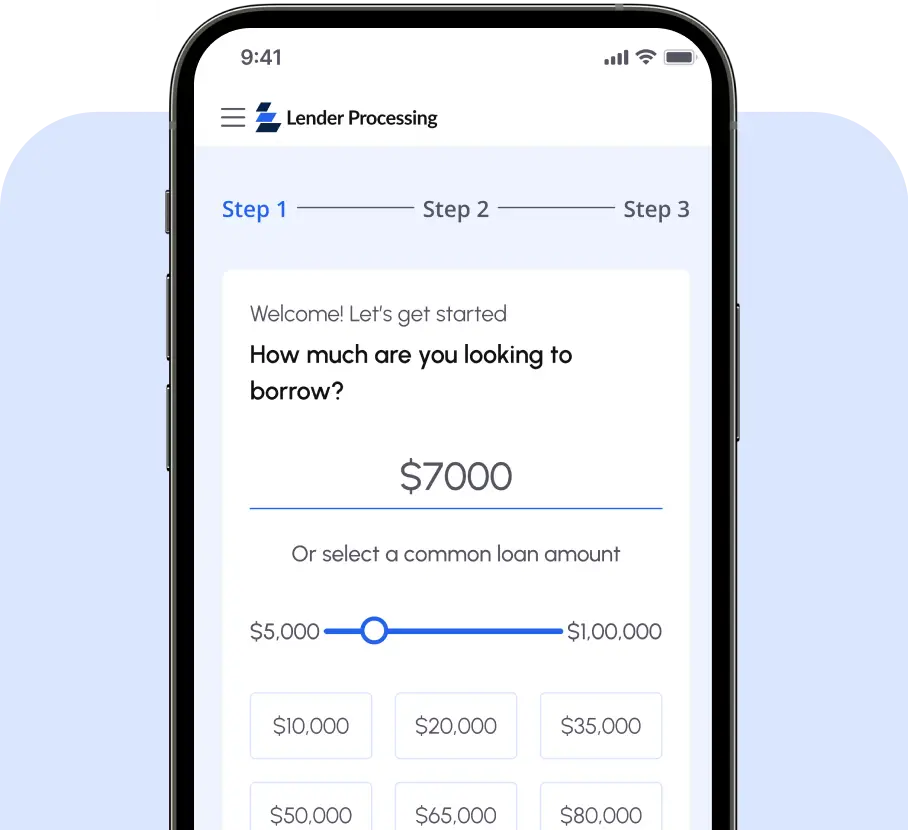

Apply Online

Tell us about your plans and financial needs. Our secure application takes just a few minutes to complete.

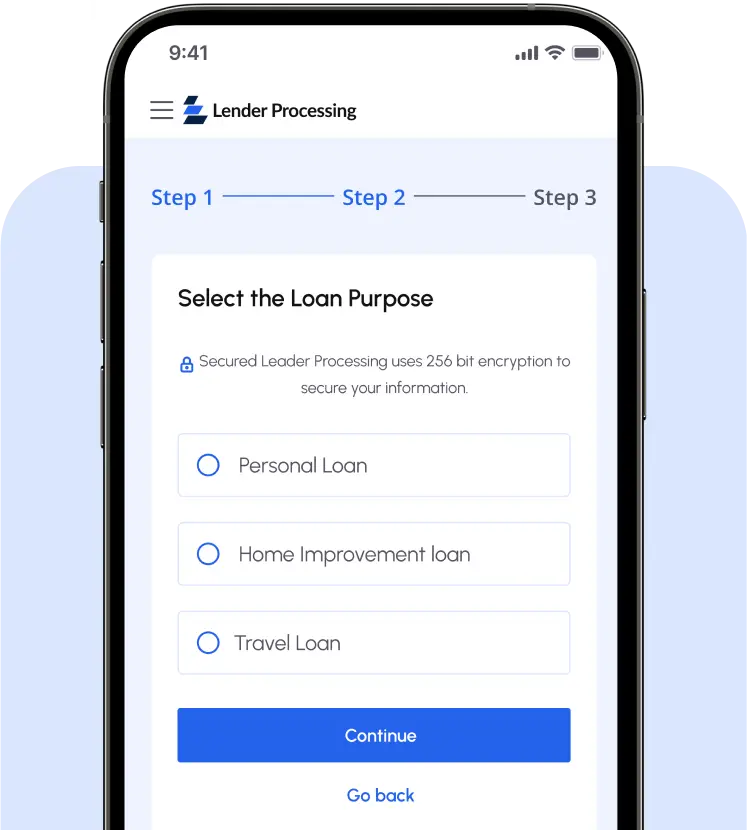

View Your Loan Options

Based on your location and credit profile, you’ll see eligible offers from Lender Processing or one of our licensed lending partners. No pressure — just clear information to help you decide.

Book Your Trip

Once approved, most loans are funded within 1 business day — so you can start planning (and packing) right away.

Why Choose Lender Processing?

Depending on your state, you’ll receive loan options from Lender Processing or our licensed lending network — all with clear terms and fast access to funds.

- Borrow $1,000–$50,000 for your next trip

- Fixed APRs starting at 6.99%

- No collateral or credit card required

- No early payoff penalties

Frequently Asked Questions

What is a travel loan?

It’s a personal loan you can use to cover trip-related expenses — then repay in fixed monthly installments.

What can I use a travel loan for?

How fast will I receive the funds?

Will checking my rate affect my credit score?

Do I need to provide collateral?

Are there any prepayment penalties?

How do I make payments?

Explore our other Loan Options

Personal Loans

For major milestones or life’s surprise expenses, our personal loans offer fast funding, fixed rates, and flexible repayment options — so you can stay in control.

Home Improvement Loans

Ready to renovate? Whether it’s a small upgrade or a major project, our home improvement loans help you bring your vision to life — without long waits.

From Bucket Lists to Boarding Passes — We’ve Got You Covered

With fast access to funds, transparent terms, and no surprises, Lender Processing supports your journey — whether we’re lending directly or working with a licensed lending partner in your state.